24+ Private mortgage lenders

Refinancing is one way to stop paying private mortgage insurance and its the only way to get rid of FHA mortgage insurance. Wait because as soon as you said mortgage lenders start going bankrupt or going out of business my mind just because Ive been doing this for a long time flashes back to.

Explore The Bilvam Regency Project In Surat Real Estates Design Real Estate Brochures Real Estate Marketing Design

LoanDepot is one of the largest non-bank mortgage lenders in the US.

. The price of digital tools and labor to combat cyberthreats is climbing experts said and cyber insurance policies are rising as much as 40 leading. Home equity loans from Cannect start at just 499 but there are other fees associated with a loan. Best Mortgage Lenders By State.

In British Columbia Mortgage Brokers are mortgage brokerages while Submortgage Brokers are those. Conventional loans can be conforming or non. For FHA loans your down payment could be as low as 35.

If the lender uses a Fannie Mae loan your down payment. The most common type of mortgage loan conventional loans are offered by private lenders and are not part of any government-insurance programs. Most companies in our list of private lenders can typically process a hard money loan in days instead of weeks.

Lenders and servicers in the past 12 months have been hit hard by data breaches compromising sensitive information on millions of customers which forced them to bear untold costs for responses. Reverse Mortgage Fundings privately backed reverse mortgage is the only private jumbo reverse from a top lender that doesnt require applicants to be at least 62 years old. Other loan programs include buy-to-rent rental financing of 24 months and long term rental financing of up to 30 years.

Their commission can be paid by the borrower or lender. To replace an adjustable-rate mortgage or ARM with a fixed-rate loan. The average 30-year fixed mortgage rate rose from around 3 in December 2021 to 581 in June 2022 according to Freddie Mac.

How Credit Scores Affect the Cost of PMI. Shop mortgage rates from trusted lenders to compare costs. Consider two individuals who each want to buy a home valued 100000 and can each put down 10000 or 10 of the value of.

Whats happening with home prices. The Equity Elite Private Reverse Mortgage. Most people who apply online will have already sent off their apps to traditional mortgage.

As Lenders Mortgage Insurance reduces Westpacs risk as a lender when providing a home loan you may be able to apply for a home loan and get into your home sooner with a lower deposit. Everything you need to know about Private Mortgage Insurance. Lenders who offer VA and USDA loans are able to qualify borrowers for 0 down.

The policy is also known as a mortgage indemnity guarantee. Mortgage insurance also known as mortgage guarantee and home-loan insurance is an insurance policy which compensates lenders or investors in mortgage-backed securities for losses due to the default of a mortgage loanMortgage insurance can be either public or private depending upon the insurer. How They Get Paid.

Mortgage brokers can also connect you to BC private mortgage lenders. 399 to 824 with autopay Fixed APR. Mortgage brokers and many mortgage lenders charge a fee for their services about 1 of the loan amount.

While 24 were between 200K - 500K. What Are Current Mortgage Rates. Credit scores dont just affect mortgage and homeowners insurance rates they also affect PMIS.

The market was good mortgage rates remained low and people itched to get. Their Affordable Loan Solution mortgage requires a low down payment of just 3 and no private mortgage. This lets you compare student loan refinance rates across multiple private lenders before you make a.

About 3 basis points higher than the national average. Private Real Estate Loans. Borrowers can also get a preapproval letter within 24 to 48 hours and they can get prequalified online within 15 minutes.

These fees are typically lower than our competitors and lower than fees you would pay to refinance your mortgagepotentially 10s of thousands of dollars lower if you need to break your mortgagewhich is why a CannectFlex loan may be right for you. Borrowers seemed desperate for money to flip houses. 2 were over 5 million.

The most common type of mortgage loan conventional loans are offered by private lenders and are not part of any government-insurance programs. Weve connected borrowers with private lenders on deals that surpassed over 100 billion in loan requests in just the last 4 years alone. What is the cost of Lenders Mortgage Insurance and who pays for it.

To fit the diverse needs of homebuyers mortgage companies offer products with a range of lengths interest rates and payment structures. High-value homeowners who are 60 or 61 can apply in RMFs participating states excluding North Carolina Utah and Texas. The cost of Lenders Mortgage Insurance is calculated as a percentage of the loan amount.

Private Lenders In Texas. Here are the 8 best mortgage lenders for September 2022 including Rocket Mortgage Bank of America Navy Federal and Guild Mortgage. Here is an example of how factors such as creditworthiness impact the cost of mortgage insurance.

Interior Savings Credit Union. Types of mortgage loans. Here is Bankrates guide to the best FHA 203k rehab mortgage lenders in 2022.

You can take. About Bay Mountain Capital.

Tm226390d3 425img010 Jpg

Tm226390d3 425img100 Jpg

Installment Loans For Bad Credit Advance America

Enstar Group Limited Sec Filing

Sustained Credit Card Borrowing Grodzicki 2021 Journal Of Consumer Affairs Wiley Online Library

24 Real Estate Banner Free Premium Templates

:max_bytes(150000):strip_icc()/Fora-fb97785e52464251ae07680b68f97673.jpg)

The Best Restaurant Business Loans For 2022

Nodoc Twitter Search Twitter

Free Cms 1500 Template For Word Fresh 26 Free Hcfa Form Separation Agreement Template How To Plan Resume Design Template

Enstar Group Limited Sec Filing

Pineyro Capital Group Inc Home Facebook

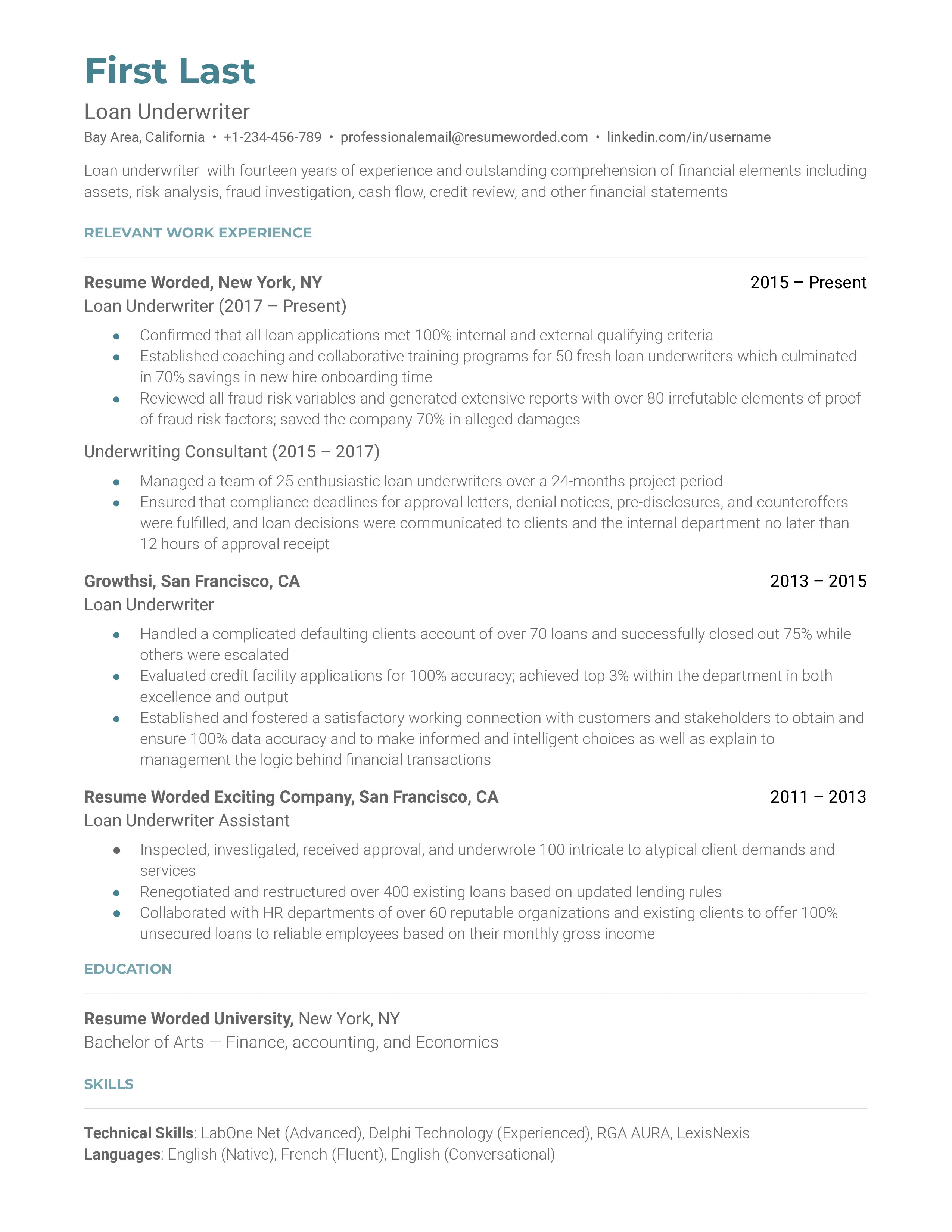

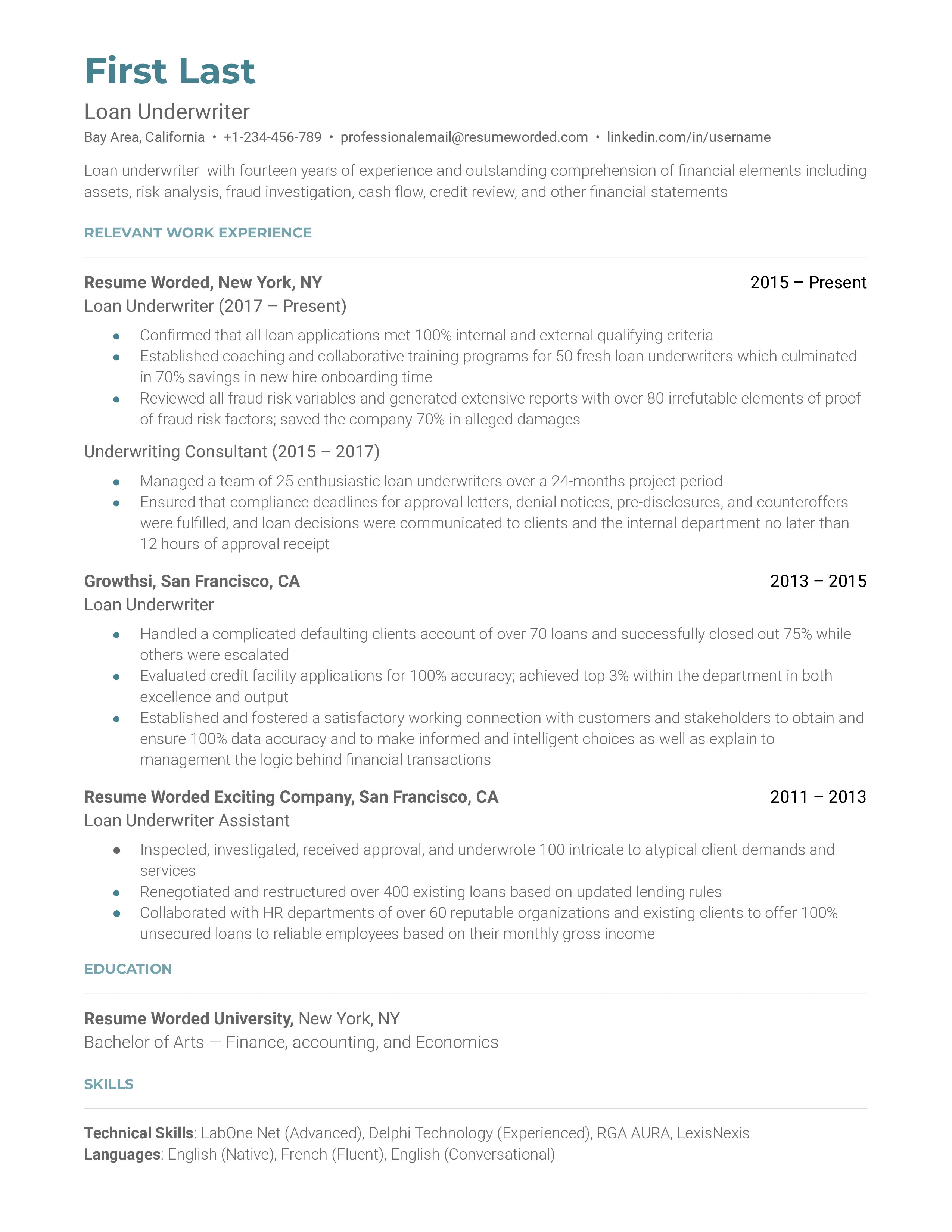

Loan Underwriter Resume Example For 2022 Resume Worded

Tm226390d3 425img092 Jpg

Savings Accounts First National Bank

Loan Document Free Printable Documents Contract Template Private Loans Loan

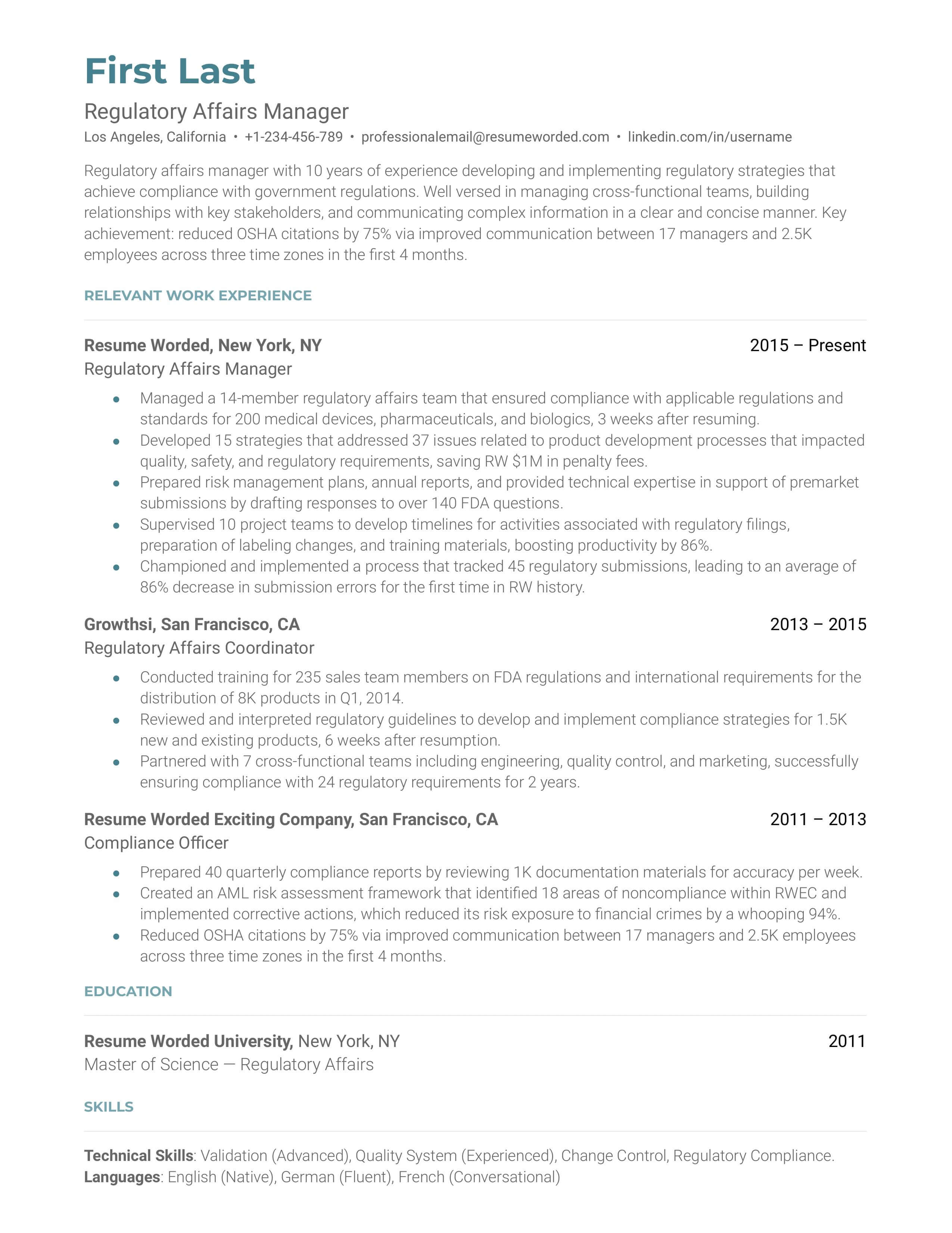

Commercial Underwriter Resume Example For 2022 Resume Worded

New Mortgage